Claimant Most Frequently Asked Questions - Unemployment Insurance

1099-G Information for Tax Year 2024

BEACON

1. What is BEACON?

BEACON is Maryland's online unemployment insurance (UI) system which allows claimants to complete several UI tasks online and access information about their claims.

In BEACON, claimants (a claimant refers to an individual who files an initial claim for UI benefits) can:

- apply for unemployment insurance benefits (also called filing an initial claim);

- file claim certifications each week;

- upload supporting documentation;

- review their benefit payment history;

- retrieve correspondence and other claimant information;

- respond to fact-finding requests;

- submit supporting documents;

- file appeals; and,

- track and pay overpayments, among other tasks.

To use BEACON, you must create an account, including a username and password, which you will use to log in to the system. When you log in to BEACON, you will be in your claimant portal. You will receive correspondence and notices about your UI claim in your claimant portal. You can also complete several UI tasks from your portal.

NOTE: In addition to BEACON, you will receive correspondence through your preferred communication method: e-mail, text message, or postal mail. You will select your preferred communication method when you file an initial claim for UI benefits.

- You may use the BEACON mobile app, MD Unemployment for Claimants, to complete some, but not all, UI tasks in BEACON (file weekly claim certifications, review UI information, update address and tax withholding status, and receive notifications). However, you can not use the app to file an initial claim.

- The app is available to download from the Google Play Store and the iOS App Store.

2. Which UI programs can I apply for using BEACON?

Claimants can use BEACON to file UI claims for programs including but not limited to:

- Regular Unemployment Insurance, including for claimants who:

- earned wages in multiple states; and

- had more than 3 employers in the last 18 months.

- Work Sharing (also called Short-Time Compensation);

- Unemployment Compensation for Federal Employees (UCFE);

- Unemployment Compensation for Ex-Service members (UCX); and,

- Extended Benefits (EB), if available. EB may be provided during periods of high unemployment, and a state must meet federally-mandated requirements to offer EB to claimants.

NOTE: If an additional federal or emergency UI benefit program becomes available, the Maryland Division of Unemployment Insurance ( the Division) website will include information about how to apply for the program.

3. How do I create a BEACON account? How do I file an initial claim in BEACON?

To use BEACON, you must create an account, including a username and password, which you will use to log in to the system.

To create a BEACON account:

- Go to the BEACON claimant portal login web page.

- Select “Get Started with BEACON.”

- After selecting the link, the question “Have you ever filed for unemployment insurance benefits in Maryland?” will display.

- If you previously filed for UI benefits in Maryland, answer “yes” and follow the prompts. This process allows you to activate your BEACON account and gives you access to your previous claim data.

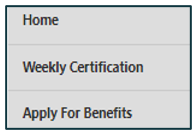

- After you activate your account, you can file an initial claim in BEACON by selecting the Apply for Benefits tab from the left menu and following the prompts.

- After you activate your account, you can file an initial claim in BEACON by selecting the Apply for Benefits tab from the left menu and following the prompts.

- If you have not filed for UI benefits in Maryland previously, answer “no” to the question “Have you ever filed for unemployment insurance benefits in Maryland?” Follow the prompts to create a BEACON account and file an initial claim.

- If you previously filed for UI benefits in Maryland, answer “yes” and follow the prompts. This process allows you to activate your BEACON account and gives you access to your previous claim data.

- The Division created the BEACON: Quick Start Instructions document to help claimants create or access their BEACON accounts.

4. How do I log in to my BEACON?

To log in to your BEACON portal:

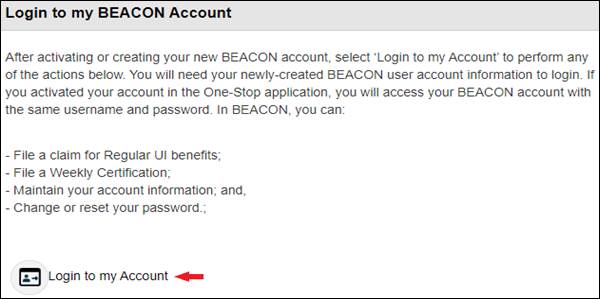

- Go to the BEACON claimant portal login web page. Select Login to My Account. You will be taken to a screen where you can enter your username and password.

- Enter your username and password.

- Enter the Captcha code shown on the screen.

- Select the login button to log into your BEACON portal.

NOTE: If you created an account in the BEACON One-Stop application, prior to the BEACON launch in September 2020, you may use this username and password to access BEACON.

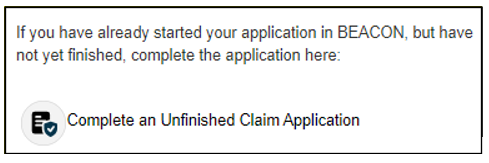

5. How do I file a claim if I started an application in BEACON, but have not completed it?

- Please go to the BEACON claimant login webpage. Then, select the Get Started with BEACON link.

- The question, Have you ever filed for unemployment insurance benefits in Maryland?, will display. If you have not filed, answer no.

- Then, select the Complete an Unfinished Claim Application link. Enter your username and password, and follow the prompts to continue.

6. How do I reset my BEACON username or password?

To reset your BEACON username or password:

- Go to the BEACON claimant portal login web page.

- Select “Login to my Account.” You will be taken to a screen where you can enter your username and password.

- Select either “Forgot Username” or “Forgot Password.”

- If you selected, “Forgot Username,” enter the email address associated with your BEACON account and enter the Captcha code.

- If you selected “Forgot Password,” enter your BEACON username and enter the Captcha code.

- Follow the prompts and enter any requested information.

- If you could not reset your username or password, call a claims agent at 667-207-6520.

7. How do I file a weekly claim certification in BEACON?

A weekly claim certification is your request to be paid unemployment insurance (UI) benefits for a particular week of unemployment. If you do not file timely weekly claim certifications, your benefit payments may be delayed/denied.

To file in BEACON:

- Log in to your BEACON portal.

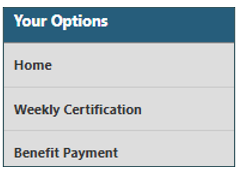

- Select the "Weekly Certification" tab from the left menu. Follow the prompts and answer the questions to file your weekly claim certification. You will be able to answer the weekly claim certification questions for the oldest week that you have available to certify.

To learn more, see the How to File a Weekly Claim Certification webpage.

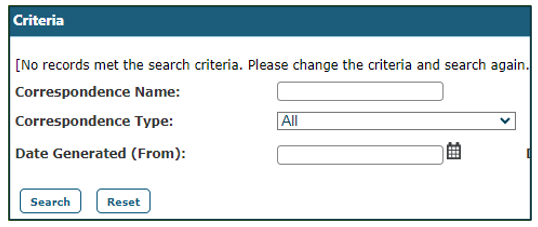

8. How do I view correspondence in BEACON?

- Login to your BEACON portal, and select the Correspondence tab from your portal’s left menu.

- Select the search tab to display your correspondence.

9. How do I upload supporting documentation in BEACON?

- Log in to your BEACON portal and select Account Profile and Maintenance from your portal’s left menu.

- Then, select Upload Document.

- Choose the Select Files button and then upload the appropriate document. Then, select the Upload Document button.

ALL documents, including photos, must be legible.

10. How do I file an appeal in BEACON?

To file an appeal (or to see if there is anything that you can appeal), log in to your BEACON portal.

- Select the "Correspondence" tab from your portal’s left menu. Then, select the search button.

- If you have a determination that you may appeal, there will be a “File Appeal” link on the end of the row of that Determination.

- Select the File Appeal link and follow the prompts to file an appeal. At the end of that process, you will receive an appeal number.

For more, see the Appeals webpage and the File an Appeal tutorial video.

Solutions to Common Technical Issues

11. I am unable to login because I keep getting a message that my username/password are ____ (not in the system; not recognized; invalid).

Please note that when creating your account, usernames CANNOT have any special characters; however, passwords MUST INCLUDE at least one special character. If your username and password follow these directives and you are still unable to login, please review the following login guides: BEACON User Guide. If you are still experiencing issues, please contact a claims agent at 667-207-6520.

12. I activated my account, but I can’t login and keep seeing the message “User ID is not defined.” What should I do?

Please note that when creating your account, usernames CANNOT have any special characters; however, passwords MUST INCLUDE at least one special character. If your username and password follow these directives and you are still unable to login, please return to BEACON and then select “Getting Started with BEACON" to try to activate your account again. If you are still experiencing issues, please contact a claims agent at 667-207-6520.

Resources and Technical Assistance

13. Where can I learn more about using BEACON?The Division created several resources to help you use BEACON, including:

- BEACON System Overview

- BEACON Claimant Tutorial Videos

- BEACON Claimant Resource Guide

- BEACON Claimant User Guide

14. Technical Support

If you require technical assistance with the BEACON system, call a claims agent at 667-207-6520. For agent hours, see the Claimant Contact Information webpage.

Benefit Payment Options - Direct Deposit or Check

Benefit Payment Options - Direct Deposit or Check

1. When will I choose a payment method?

You will be prompted to choose your unemployment insurance (UI) benefit payment method (direct deposit or paper check) when you file an initial claim (see the Claims Filing - Initial Claims section of this webpage and How to File an Initial Claim in BEACON).

After you file an initial claim, you can change your payment method at any time in BEACON or the MD Unemployment for Claimants mobile app (download from iOS App Store or Google Play Store).

- For more information about filing an initial claim, see the Claims Filing - Initial Claims section of this webpage.

2. How can I select my benefit payment method?

Initial Claim

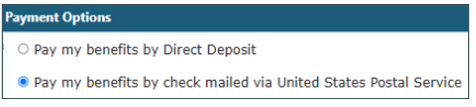

When prompted during the initial claim process, you will choose to receive benefit payments by direct deposit or by check.

- If you choose direct deposit, you will be prompted to enter your bank account information (account type, routing number, bank name, etc.). If you file an initial claim by phone, you must enter your bank account information in BEACON to enroll in direct deposit.

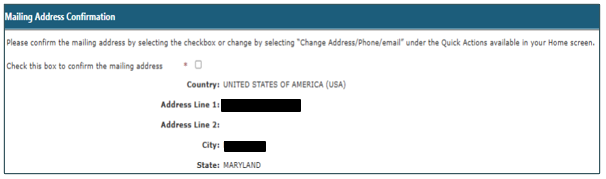

NOTE: For the safety of your personal information, Division staff are unable to update or enter your bank account information. - Check - If you choose check, you will select the check box to confirm your mailing address. Select “Next” to continue the initial claim process.

- Direct Deposit - After entering your bank account information, select "verify."

- When your information is verified, you will see the following message: “Bank details verification is successful. Payment method is updated.” If you do not see this message, your direct deposit enrollment is not complete. Select “Next” to continue the initial claim process.

Update Payment Method After Filing an Initial Claim

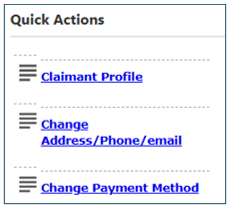

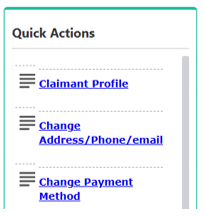

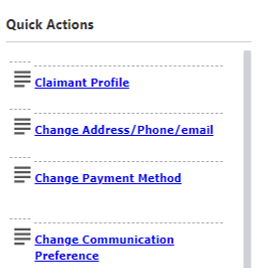

- To change your payment method in BEACON, log in and select “Change Payment Method” under the Quick Actions section of your BEACON portal, and follow the prompts.

NOTE: You may be prompted to complete the TrueID identity verification process when you file an initial claim or update information in BEACON. For details, see the TrueID Identity Verification Process FAQs on this page.

3. What should I do if my bank account information is not verified?

In some cases, your bank account cannot be verified because the personal information (name or address) listed in BEACON does not match the information associated with your bank account.

You can update your personal information in BEACON or with your bank (if updating through the bank, wait three business days for the changes to take effect).

- After you correct your information, enter your bank account information in BEACON again, and then select “verify.” Once the verification process is successful, a claimant’s direct deposit enrollment is complete.

4. What is the micro deposit process?

If further verification of your bank account information is needed, you will complete a micro deposit process.

- You will receive two deposits of less than $1.00 into your bank account, usually within 1-2 business days.

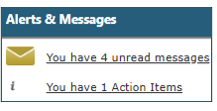

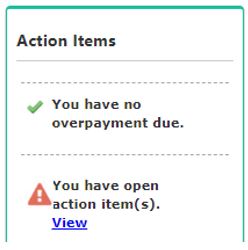

- Once you have received the micro deposits in your bank account, log in to BEACON to confirm the amount of the deposits. You will receive an Action Item in BEACON with instructions (to access, select the Action Items link under the Alerts & Messages section in BEACON).

NOTE: You cannot use the MD Unemployment for Claimants mobile app to confirm the micro deposits. - One withdrawal (equal to the amount of the two micro deposits) will be made from your account.

NOTE: If you complete the micro deposit process and your bank account information is not approved or you are unable to receive direct deposits, select check as your payment method.

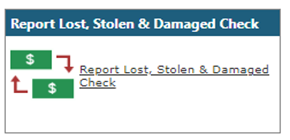

5. What should I do if my unemployment benefit check is lost, damaged or stolen?

You can report a lost, damaged or stolen check in your BEACON claimant portal .

- From your BEACON homepage , select “Benefit Payment” from the left menu.

- Then select “Lost, Stolen & or Damaged Check.” Then, select “Search.

- Under “Payment History,” select the week ending date related to the benefit payment.

- Once you have chosen the date, select “Lost, Stolen or Damaged Check(s).”

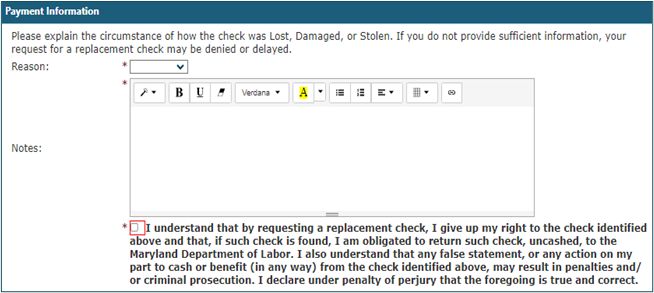

- In the Lost, Stolen or Damaged Check Details section, select whether your payment was lost, stolen, or damaged from the Reason dropdown menu. Then, enter any additional pertinent information in the “Notes” section.

- You will then be asked to confirm or update your address.

- After you confirm your address, you may submit your request to reissue your payment.

You can change/update your mailing address in BEACON and through the MD Unemployment for Claimants mobile app (available to download from the iOS App Store or Google Play Store).

- To do so in BEACON, log into your BEACON portal. Go to the Quick Actions section, select, “Change Address/Phone/email,” and update your mailing address.

- If you choose check as your new payment method you must verify your mailing address in BEACON, regardless of whether or not your mailing address has changed.

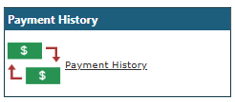

7. How can I find out whether I was paid for a particular week?

Please log into BEACON, select “Benefit Payment” from the left menu, and then “Payment History.”

Claims Filing - Initial Claims

Claims Filing - Initial Claims

Filing an initial claim (also called applying for unemployment insurance benefits) is the first step in your unemployment insurance (UI) process. You must file your claim before you can receive UI benefit payments.

The Maryland Division of Unemployment Insurance (the Division) will use your initial claim in determining if you are eligible for UI benefits. See the information below to learn more.

1. When should I file my initial claim?

You should apply for UI benefits (also called filing an initial claim) immediately following your last day of work. Your eligibility for UI benefits cannot be determined until your initial claim is filed.

To learn more about how the Division determines if you are eligible for UI benefits, see the Eligibility Requirements section of the Claimant FAQs webpage.

2. How do I file an initial claim?

You can file an initial claim (also called applying for UI benefits) in the online BEACON UI system, 24/7, or by calling a claims agent at 667-207-6520 (Monday to Friday, 8:00 a.m. to 4:00 p.m.).

- If you have never created an account in BEACON, you can file an initial claim on the BEACON claimant login page by selecting the Get Started with BEACON link and following the prompts.

- If you have created an account in BEACON, you can apply by logging in to BEACON, selecting the Apply for Benefits tab from the left menu, and following the prompts.

To learn more about using BEACON, see the:

- BEACON section of the Claimant FAQs webpage

- BEACON Claimant Tutorial Videos

- BEACON Claimant Portal User Guide

Reapplying for UI Benefits

In some circumstances, you may be required to file an initial claim again (also called reapplying for UI benefits) to reestablish your eligibility for benefits. These circumstances include, but are not limited to:

- your monetary eligibility needs to be redetermined.

Note: A claimant’s monetary eligibility may need to be redetermined when the calendar quarter changes (calendar quarters end on March 31, June 30, September 30, and December 31). To learn more about monetary eligibility, see question 5 (How does the Division determine if I am eligible for UI benefits?). - your benefit year has expired.

Note: The benefit year is the 52-week period starting on the claim’s effective date, which is the Sunday of the week in which a new claim is filed. For more, see Question 11 (What is the benefit year? How long does it last?).

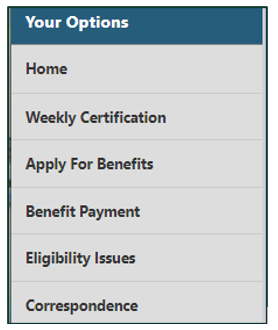

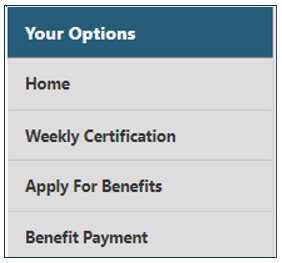

If you need to reapply for benefits, when you log in to BEACON, the left menu labeled Your Options will include an “Apply for Benefits” tab. You should select this tab and follow the prompts to reapply. For more information, see the Reapplying for UI Benefits in BEACON section of the Claimant FAQs webpage.

3. What information do I need to file my initial claim?

When you file your initial claim you will need to provide the following information:

- Personal Information: Your name, date of birth, Social Security number, residential and mailing address, telephone number, and email address

- Employer Information: For each employer you worked for during the last 18 months, please provide the: name, address, and telephone number for each employer, employment start and end dates; if applicable, your return-to-work date, and reason for separation from each employer

- Citizenship Status: If you are not a U.S. citizen or national, your Alien Registration Number

- Former Military Status, if applicable: If you were in the military within the last 18 months, your former military status and DD-214 - Service document is needed

- Union Name and Local Number, if applicable

- Former Federal Government Employee Status, if applicable: If you are a former federal employee, provide Form SF-50 or SF-8

- Name, Date of Birth, and Social Security Number for each Dependent

NOTE: A dependent is defined as a son, daughter, stepchild or legally adopted child under the age of 16 whom you support. At the time you file your initial claim, only one parent may claim a dependent(s), up to a maximum of five (5), during any one year benefit period. See question 13 for more information about dependents.

For more details about information and/or documentation you may need to provide, see the Information and Documents Needed for Claims Filing webpage.

4. What payments must I report when I file an initial claim? How will these payments affect my UI benefits?

When you file an initial claim, you are required to report any payments you received or know you will receive. This includes severance, vacation, holiday, bonus, or retirement payments, back pay, damages, and special payments. If you fail to report these payments, the Division may determine you were overpaid and require you to repay any overpaid benefits (with possible interest, fines, and penalty fees). To learn more about overpayments, see the Overpayments and Fraud FAQs.

- If you receive any of the payments listed above, your UI benefits may be reduced or denied (for the weeks affected by the payments). If you receive back pay from your former employer, your UI benefits will be denied (retroactively for any week to which back pay is attributable).

Vacation, Holiday, Bonus Pay, Back Page/Damages or Special Payments - If you receive vacation, holiday, bonus, back pay or damages, and/or other special payments after filing an initial claim, report it to a claims agent as soon as possible by calling (667) 207-6520. For claims agent hours, see the Claimant Contact Information webpage. Your benefits may be reduced or denied for the weeks these payments affect, depending on the circumstances.

Severance Payments - If you receive severance payments after you file an initial claim, you must report them by calling a claims agent at (667) 207-6520. Do not report severance payments as wages when filing your weekly claim certification. Severance payments are deductible from UI benefits (based on the number of weeks of your regular wage the payments cover). Once your severance payments are exhausted, you may receive UI benefits, if you are eligible.

Retirement Payments - You must report lump sum or monthly retirement payments (from any employer that you worked for during the last 18 months) on your initial claim. These payments may be deductible from UI benefits, depending on the payment amount, the type of retirement payment, etc.

- Retirement payments include: pension, annuity, or retirement/retired pay (from a trust, annuity, profit sharing plan, insurance fund, insurance or annuity contract, or any similar lump sum or periodic payment).

- If you receive your first retirement payment after filing your initial claim, and the retirement payment(s) was not previously reported to the Division, you must report the payment on your weekly claim certification. You must also report any changes to the amount of your retirement payment.

NOTE: You are NOT required to report Social Security income on your initial claim or weekly claim certification.

IMPORTANT: Depending on your circumstances, you may be required to report additional payments/earnings on your weekly claim certifications (including any earnings from employment, self-employment, etc.). Please see Unemployment Insurance in Maryland; A Guide to Reemployment and the Claims Filing - Weekly Claims Certifications section of the Claimant FAQs webpage to learn more.

5. How does the Division determine if I am eligible for UI benefits?

When you file an initial claim, the Division will determine if you are monetarily eligible and non-monetarily eligible to receive UI benefits. To be monetarily eligible for UI benefits, you must have earned wages in covered employment during at least two calendar quarters in the base period (standard or alternate). To learn more about the base period, see questions 9 and 10 (What is the Standard Base Period? and What is the Alternate Base Period?).

Covered employment is any service performed for remuneration (payment) whether full-time or part-time, that is used as the basis for UI benefits. When an individual performs a service for an employer in return for wages, the individual is likely covered for UI purposes. Some positions, such as an independent contractor, are exempt from covered employment. For exemptions, see Employers’ General UI Contributions Information and Definitions.

To determine if you are non-monetarily eligible, the Division considers the reason you separated from employment, whether you are able to work, available for work, and actively seeking work, and whether you are receiving any payments that are deductible from UI benefits (such as vacation pay, holiday pay, special pay, severance pay, a pension, or back pay or damages).

6. What if I worked in a state other than Maryland or more than one state?

If all of your work in the last 18 months has been in a state other than Maryland, your claim should be filed against that state. The laws of that state will govern your claim.

If you worked in Maryland and other states, you may have the option to file your claim against any one of the states in which you worked and have monetary eligibility. You may also choose to combine wages from the states in which you worked to establish a combined wage claim. A combined wage claim may result in a higher weekly benefit amount. Combined wage claims can be filed online via BEACON or by calling 667-207-6520.

7. Where should I file my UI claim if I work in another state but reside in Maryland?

If you work in another state but reside in Maryland, you should file your claim in the state you work in. A UI claim is filed against the state where you worked, not where you reside.

8. Are UI payments taxable?

Yes, your UI benefits are subject to federal and state taxes. You can choose to have either federal taxes (10%), Maryland state taxes (7%), both (17%), or neither deducted from your weekly UI benefits during the initial claim process.

NOTE: You will choose your tax withholding option when you file an initial claim. If you wish to change your tax option after you file an initial claim, you can do this in BEACON.

You must report the amount of UI benefits you received when you file your income taxes. To learn more, see the 1099-G Information webpage.

9. What is the Standard Base Period?

The standard base period is the first four of the last five completed calendar quarters before your claim effective date. The wages you earned during those quarters are used to determine if you are monetarily eligible for UI benefits.

Note: Your claim effective date is the Sunday of the week during which the initial claim is filed. For example, if you file a claim on Wednesday, March 4, the claim’s effective date is Sunday, March 1.

You must have earnings in at least two of the four quarters during the base period (as of the date you file your claim). See the diagram below.

Month of New Claim: |

Your Standard Base Period is the 12-Month Period Ending the Previous: |

January, February or March |

September 30 |

April, May or June |

December 31 |

July, August or September |

March 31 |

October, November or December |

June 30 |

10. What is the Alternate Base Period?

If you are not monetarily eligible for any UI benefits using the standard base period, you may be eligible using the alternate base period (ABP). The ABP is the most recently completed four calendar quarters of wages before your claim effective date. The wages you earned during those quarters are used to determine if you are monetarily eligible for UI benefits.

Note: Your claim effective date is the Sunday of the week during which the initial claim is filed. For example, if you file a claim on Wednesday, March 4, the claim’s effective date is Sunday, March 1.

Your weekly benefit amount (WBA) will be approximately one half of your gross weekly wage up to the maximum weekly benefit amount. You must have earnings in at least two of the four quarters during the ABP (as of the date you file your claim). See the diagram below.

Month of New Claim: |

Your Alternate Base Period is the 12-Month Period Ending the Previous: |

January, February or March |

December 31 |

April, May or June |

March 31 |

July, August or September |

June 30 |

October, November or December |

September 30 |

11. What is the benefit year? How long does it last?

Your benefit year is a one-year period (52 weeks) beginning the Sunday of the week in which you file your initial claim. Under Maryland’s regular UI program, you may receive up to 26 weeks of your weekly benefit amount per benefit year.

NOTE: If you receive partial UI benefits (for example, due to working part-time while receiving UI benefits) your UI benefits may last more than 26 weeks. However, you will not receive more than the equivalent of 26 weeks of your weekly benefit amount. For more about the weekly benefit amount, see Question 13 (How much money can I receive in UI benefits? How is my weekly benefit amount (WBA) determined for regular UI benefits?).

You may receive more than 26 weeks of benefit payments in a benefit year if a federal extension program is available. You will be notified if an extension program is in effect.

For example, if you filed your initial claim on Friday, March 6, your benefit year would start on Sunday, March 1. This would be your “Benefit Year Beginning” or “Claim Effective Date.”

For any questions or concerns, please call a claims agent at 667-207-6520.

12. I filed my initial claim. How do I know if I am eligible for UI benefits?

After you file an initial claim, you will receive a Statement of Wages and Monetary Determination form, which will tell you whether or not you are eligible for UI benefits. This form will show your base period employer(s), wages earned from each employer, and your weekly benefit amount (WBA).

The determination will be sent in BEACON and through your preferred communication method (selected when you filed an initial claim). You can also update your preferred communication method in BEACON (log in, navigate to the Quick Actions section, select Change Communication Preference, and follow the prompts).

If you think a correction should be made to your determination, contact a claims agent immediately at 667-207-6520. You may be asked to submit copies of your pay stubs, W-2 forms, and any other proof of wages that you have.

13. How much money can I receive in UI benefits? How is my weekly benefit amount (WBA) determined for regular UI benefits?

The weekly benefit amount (WBA) is a fixed weekly benefit payment a claimant who is eligible for UI benefits will receive from the Division. The WBA is based on the wages you earned during the base period (standard or alternate). The WBA in Maryland ranges from a minimum of $50 to a maximum of $430. You may receive up to 26 weeks of your WBA per benefit year (under Maryland’s regular UI program), as long as you meet all eligibility criteria.

NOTE:

If eligible, you will be paid a dependents’ allowance of $8 per dependent (up to a maximum of five dependents). If you receive dependents’ allowance, you will still not receive more than the $430 maximum WBA.

If you earn and report wages that are less than your WBA, you may receive partial benefits.

If you receive partial UI benefits, your UI benefits may last more than 26 weeks. However, you will not receive more than the equivalent of 26 weeks of your weekly benefit amount. A claimant’s maximum benefit amount and monetary balance are listed in BEACON (under the Claim Information section of the portal’s homepage).

-

View a schedule of UI Benefits.

Claims Filing - Weekly Claim Certifications

Claims Filing - Weekly Claim Certifications

1. What is a weekly claim certification and when should I file my weekly claim certification?

A weekly claim certification is your request to be paid unemployment insurance (UI) benefits for a particular week you are unemployed. After you file your initial claim for benefits, you must file a weekly claim certification for each week that you are unemployed and requesting benefit payments.

The Maryland Division of Unemployment Insurance (the Division) benefit week is from Sunday to Saturday. When you file a weekly claim certification, you are requesting payment for the prior completed benefit week. You may file your claim certification (immediately following the week for which you are requesting payment) beginning on Sunday at 12:01 a.m. until Saturday at 11:59 p.m.

For example, to request payment for the benefit week that started on Sunday, May 9, and ended on Saturday, May 15, file your claim between Sunday, May 16, and Saturday, May 22. However, the Division strongly recommends that you file your claim early in the week.

Failure to file your weekly claim certifications on time may result in a delay or denial of benefits. If your weekly claim certifications are filed properly, you will receive a processing number. If you do not receive a processing number, contact a claims agent immediately at 667-207-6520 (8:00 a.m. to 4:00 p.m., Monday to Friday).

2. Why do I need to file a claim certification every week?

To receive UI benefits, you must certify (by answering claim certification questions) each week that you are still unemployed and eligible for benefits. If you do not complete a weekly claim certification, you will not receive unemployment benefits.

3. How do I file a weekly claim certification?

To request benefit payments, you must file a weekly claim certification. You may file your weekly claim certification:

- online through your BEACON portal;

- by calling 410-949-0022 or 800-827-4839; or

- through the MD Unemployment for Claimants mobile app (available to download from the iOS App Store or Google Play Store).

Each method is available 24/7. The weekly claim certification questions are identical no matter which method you use to file.

To file your weekly claim certification in BEACON, go to the BEACON login page and enter your username and password to access your BEACON claimant portal.

To file your weekly claim certification, you can select "Weekly Certification" from the menu on the left side of your portal screen.

![]()

You can also file a weekly claim certification by accessing your Action Items. You will have an Action Item to complete your claim certification when one is available to be filed. Navigate to the Action Items section of your portal homepage and select the “View” link (this link will display if you have an open action item). On the next screen, select the appropriate action item.

Then, review the "Guidelines for Requesting a Claim Week." Once you read through the guidelines, select "Next" at the bottom of the screen.

You will now be able to answer the weekly claim certification questions for the oldest week that you have available to certify. Please ensure that you answer the questions correctly for the week displayed.

You will be asked to certify that the information you provided on your weekly claim certification is correct. To acknowledge that the information you provided is correct, select the checkbox on the appropriate screen. You will then be able to submit your certification for that week.

You may continue the same process for other certification weeks available. Continue to complete and file claim certifications for every week that you are out of work.

4. Can you explain the weekly claim certification questions?

-

Question 1. Were you able and available to work in your occupation without restrictions during the week?

This means you were physically and mentally able to work and available to work all hours on any days that are customary for your occupation.

This question is asking whether you were able to work and available for work without any restrictions.

- To be able to work without restrictions means that there are no physical limitations on your ability to perform the work that you customarily perform.

- To be available for work without any restrictions means that there are no limitations on your time which would make you unavailable for work during the hours that your work is customarily performed.

If there were restrictions on your ability to work and/or availability to work during the week, including restrictions due to lack of childcare or transportation, then answer “NO” to this question. If there were no restrictions on your ability to work and availability for work, then answer “YES” to this question.

Question 2. Did you attend school or training during the week?

This question is asking if you attended school or any training during the week, including school/training approved by the Division of Workforce Development and Adult Learning (DWDAL). This includes any classroom or training session that occurs online or virtually.

Select “YES” if you attended school or training. Select “NO” if you DID NOT attend school or training.

NOTE: If you are attending school or training that is not approved by DWDAL, you may be contacted by the Division for a telephone fact-finding appointment.

Question 3. Did you actively search for work during the week?

This question is asking if you met the Division’s active search for work requirement during the benefit week. If you do not meet the active search for work requirement, your benefit payments may be delayed or denied.

To satisfy the active search for work requirement, you are required to:

- complete your registration with the Maryland Workforce Exchange (MWE);

- upload or create a résumé in MWE, make the résumé viewable to employers, and maintain an up-to-date résumé in MWE while collecting UI benefits;

- After you complete your MWE registration, check your MWE inbox frequently for information about weekly tasks or actions that you are required to complete. Failure to complete these activities may result in a delay or denial of your UI benefits.

- complete at least three valid reemployment activities per week, which must include at least one job contact; and,

- keep a detailed weekly record of all completed job contacts and valid reemployment activities. You are strongly urged to use the Job Contact and Reemployment Activity Log, located in MWE, to keep this record.

Detailed instructions for registering with MWE and entering your job contact(s) and valid reemployment activities are available online, as well as in this video tutorial. A full list of valid reemployment activities is also available on the Division’s website.

Question 4. Did you work either full time or part time during the week?

This question asks whether you worked or earned any income during the week. This includes payment from permanent or temporary work, part time work, self-employment, odd jobs, tips, paid training, remote work, and etc.

Payments must be reported in the week that you performed the work (with the exception of commission payments. See Question 5 below for details about commission payments). If you have not been paid yet, you still must report your earnings. If you answer “YES,” then you will be asked to report your gross earnings. Your gross earnings refer to the total amount you earn before taxes or deductions (such as for medical insurance premiums) are taken out.

NOTE: If you begin working full-time, you are not unemployed, and you are not entitled to UI benefits. If you are working a full-time temporary job and become unemployed after the job ends, you may reopen your claim, if you have remaining benefits.

FRAUD WARNING: If you make a false statement or representation, or knowingly fail to disclose a fact to obtain or increase benefit payments, you may be disqualified from receiving UI benefits. Additionally, you may be required to repay any benefits fraudulently obtained, with interest and fees.

Question 5. Did you receive any commission earnings during the week?

This question asks you to report any commission pay that you received in the week. Commission payments are reported the week they are received, not when the job was done. If you answer “YES,” then you will be asked to report your gross wages. Your gross wages refer to the amount of money that you receive for work before taxes or deductions (such as for medical insurance premiums) are taken out.

Question 6. Did you receive your first payment from a pension that you have not already reported? Do not include Social Security benefits.

You must report any lump sum pension or monthly pension payments you receive from any employer for whom you have worked during the last 18 months. These payments may be deductible from UI benefits. It is required that you report the effective date of any pension payments, even if the actual payments are received at a later date. You must also report any changes to your pension amount.

Question 7. Do you authorize the Maryland Department of Labor to share information from your unemployment claim with Maryland Health Connection so that Maryland Health Connection can contact you to help you enroll in free or low-cost health insurance?

This question is asking if you are comfortable with information on your unemployment insurance claim being shared with Maryland Health Connection. If you choose to share your information, Maryland Health Connection will contact you about free or low-cost health insurance. Please select “yes” to share this information or select “no” if you do not want to share your information.

Your answer to this question will not impact your eligibility for unemployment insurance benefits.

Yes, you must report your gross earnings. Your gross earnings refer to the total amount that you earned before any taxes or deductions, such as for medical insurance premiums, were taken out.

Denials and Payments

1. What does it mean to be disqualified? What can cause a disqualification?

Being disqualified (also called being penalized) means that a determination was made to deny your unemployment insurance (UI) benefit payments. This may occur if you fail to meet a UI requirement(s) (in accordance with the Maryland Unemployment Insurance law).

- For more about Maryland’s UI requirements, see the Eligibility Requirements section of the Claimant FAQs webpage and Unemployment Insurance in Maryland; A Guide to Reemployment.

When the Maryland Division of Unemployment Insurance (the Division) makes a determination that affects your eligibility for benefits, you will receive a Notice of Benefit Determination (sent through your preferred communication method and available in your BEACON portal).

- The Notice of Benefit Determination will explain why you were allowed or denied UI benefits. If you were denied, the determination will include the:

- type of penalty imposed; and,

- time period for the denial, if applicable (if your benefits are denied for a certain number of weeks).

2. What happens if I am disqualified?

If you are disqualified from UI benefits, you will not receive UI benefit payments until you meet the requirements to receive benefits or the penalty is satisfied. For more information about the reasons your benefits may be disqualified and any related penalties, see the Issues, Disqualifying Reasons, and Penalties webpage.

3. What should I do if I wish to appeal the determination?

The Notice of Benefit Determination will include your appeal rights and the last date to file an appeal on time. If an appeal is filed late, it will be determined whether the individual had good cause to file late.

- You may file an appeal with the Lower Appeals Division if you disagree with a determination made by the Division that affects your eligibility for benefits. Information about filing an appeal is also available on the Lower Appeals webpage.

- If you disagree with a decision the Lower Appeals Division made, you can appeal to the Board of Appeals. To learn more, see the Board of Appeals FAQs.

The easiest way to file an appeal is to use BEACON. To file in BEACON:

- Log in to your BEACON portal;

- Select the Correspondence tab from your portal’s left menu, and then select Search;

- Locate the appropriate determination. If the determination is appealable, there will be a File Appeal link in the same row as the determination;

- To appeal that determination, select the File Appeal link and fill out the form;

- When you complete the process, you will be issued an appeal number.

If you do not wish to use BEACON, your appeal request can be e-mailed, faxed, or mailed (see the contact information below).

Lower Appeals Division

2800 W. Patapsco Avenue

Baltimore, MD 21230

Telephone: 410-767-2421

Fax: 410-225-9781

e-mail: UILowerAppeals.Labor@maryland.gov

- Please note that e-mail (UILowerAppeals.Labor@maryland.gov) is the most efficient way to reach the Lower Appeals Division.

Your written appeal request (e-mailed, faxed, or mailed) must include:

- The name and date of the determination you wish to appeal;

- Your name as it appears on the determination you wish to appeal;

- Your claimant ID number and/or your Social Security number;

- A telephone number where you can be reached; and

- A brief statement about why you disagree with the determination you wish to appeal.

NOTE: If a Notice of Benefit Determination involves an employer you worked for, that employer also has the right to appeal the decision. If your employer files an appeal it is very important for you to be available for that appeal hearing, since information presented during the hearing may impact your eligibility for UI benefits.

If either you or your employer files an appeal and you are still unemployed, you must continue to file your weekly claim certifications to receive benefit payments. If you do not continue to file your weekly claim certifications, you will not receive benefits, even if you win the appeal.

Eligibility Requirements

1. What are the requirements to be eligible for unemployment insurance benefits?

After you file an initial claim for unemployment insurance (UI) benefits, the Maryland Division of Unemployment Insurance (Division) will determine whether you meet monetary and non-monetary eligibility requirements to be eligible for UI benefits.

- To be monetarily eligible, you must have worked and earned sufficient wages during the standard base period or alternate base period The standard base period is the first four of the last five completed calendar quarters before the claim effective date.

NOTE: Your claim effective date is the Sunday of the week in which you filed your initial claim. For example, if you file a claim on Wednesday, March 4, the claim’s effective date is Sunday, March 1.

To learn more, refer to question 7 “What is the Standard Base Period?” under the Claims Filing - Initial Claims section of this webpage.

If you are not monetarily eligible based on the standard base period, the Division will determine if you are eligible based on the wages you earned in the alternate base period (i.e., the four most recently completed calendar quarters before the claim effective date. To learn more, refer to question 8 “What is the Alternate Base Period.” under the Claims Filing - Initial Claims section of this webpage. To be non-monetarily eligible, the Division will consider whether you are unemployed due to no fault of your own, whether you are able, available, and actively seeking work, and whether you received any payments that may be deducted from UI benefits (such as vacation pay, holiday pay, special pay, severance pay, retirement/pension payments, or back pay/damages).

For information about how to file an initial claim, including what information you may need, please see the Claims Filing - Initial Claims section of this webpage.

2. What are my responsibilities as a recipient of UI benefits?

A claimant (an individual submits a claim for UI benefits) must fulfill the following responsibilities to be eligible for UI benefits each week:

Be able, available, and actively seeking work. See below for details about the actively seeking work requirement.

File weekly claim certifications (also known as a request for payment) on time. For more details see question 1 “What is a weekly claims certification and when should I file my weekly claim certifications?” under the Claims Filing - Weekly Claims Certifications section of this webpage.

Report all payments. You are required to report your gross earnings (from wages, self-employment income, commission payments, tips, odd jobs, etc.) when you file your weekly claim certification. You must also report the first payment from a pension you did not previously report on your claim certification. For more details, see the Claims Filing - Weekly Claims Certifications section of this webpage and Unemployment Insurance in Maryland; A Guide to Reemployment.

- If you receive certain payments (severance, vacation, holiday, bonus, back pay or damages, or other special payments) after filing an initial claim, you must report it by calling a claims agent at (667) 207-6520. For more information about payments which must be reported on your initial claim and/or your weekly claim certification, see the Unemployment Insurance in Maryland; A Guide to Reemployment.

NOTE: Wages, including tips, must be reported in the week that the money is earned, not the week it was actually paid. However, commission payments must be reported in the week that they are paid to you.

Be available and/or contact the Division and/or the Maryland Division of Workforce Development and Adult Learning (DWDAL) when instructed to do so. DWDAL may select you to participate in a Reemployment Services and Eligibility Assessment (RESEA) federal workshop. If selected, you are required to attend and complete the workshop. For more details, please see Unemployment Insurance in Maryland; A Guide to Reemployment

Accept suitable work, when it is offered to you. If you refuse an offer of work, the Division must determine if the job was suitable and whether you refused with good cause. Your previous work experience, distance from your home, length of unemployment, safety, risk to your health, prospects for obtaining work in your customary occupation, are some, but not all, of the factors the Division considers in determining whether the work is suitable.

- Actively Seeking Work Requirements

Satisfy the Actively Seeking Work requirement (also called the work search requirement) in which you must complete at least three valid reemployment activities per benefit week (unless under a special exemption). At least one of the three valid reemployment activities must be a job contact.

A reemployment activity is an activity that may reasonably lead to you becoming reemployed. Valid reemployment activities must be aimed toward reemployment in a position that you are qualified for based on your customary occupation, experience, skills, education, and/or training in light of labor market conditions.

A job contact refers to an action(s) you take to contact an employer in an attempt to secure employment. Job contacts include:

- submitting a job application to an employer (in person, email, online, fax);

- making an in-person contact with a potential employer;

- attending a job interview;

- contacting an employer through another method appropriate for the occupational classification; or,

- making contact through a method specified by the employer.

Keep a detailed record of your completed job contact(s) and reemployment activities. Using the Job Contact and Reemployment Activity Log, located in the Maryland Workforce Exchange system, is the easiest way to do this. For details, see the Maryland Work Search Requirements webpage and the Maryland’s List of Valid Reemployment Activities webpage.

Register with the Maryland Workforce Exchange system. Complete registration instructions are available online.

- You must also upload or create a résumé in MWE, make the résumé viewable to employers, and maintain an up-to-date résumé in MWE while collecting UI benefits;

- After registering, claimants should check their MWE inboxes frequently throughout the week. The inbox contains important information about weekly activities that the claimant must complete. Failure to complete these activities may result in a delay or denial of the claimant’s UI benefits.

3. Can I file a claim if I quit my job or if I am fired from my job?

Yes, you may apply for UI benefits (also called filing an initial claim) regardless of the reason you separated from your employment. However, filing a claim does not necessarily mean you will be eligible to receive UI benefits.

If you quit a job without good cause or valid circumstances attributable to your employment, UI benefits may be denied until you become reemployed and earn at least 15 times your weekly benefit amount in covered employment.

When an individual performs a service for an employer in return for remuneration (payment), the individual is likely performing covered employment. For more, see Unemployment Insurance in Maryland; A Guide to Reemployment.

If you voluntarily quit a job with good cause or valid circumstances attributable to your employment and you meet all other eligibility requirements, you may be eligible for UI benefits. However, your UI benefits may be denied for five to 10 weeks before you receive UI benefits, depending on the circumstances. For more, see the Issues, Disqualifying Reasons, and Penalties webpage.

If you are discharged from employment due to no fault of your own, you may be eligible for UI benefits, if you meet all requirements.

If you are discharged due to simple or gross misconduct, you may be eligible for UI benefits. However, a penalty may be imposed. If aggravated misconduct applies, UI benefits may be denied. For more, see the Issues, Disqualifying Reasons, and Penalties webpage.

However, as each claimant’s circumstances are different, your eligibility for UI benefits can not be determined until you file an initial claim. After you file your initial claim, a claims agent will determine if you are eligible.

4. Am I eligible to receive UI benefits if I am a full-time employee but only working part-time hours?

If your employer reduced your hours from full-time to part-time or if you lost your full-time job and are currently working part-time, you may file a claim to determine if you are eligible for UI benefits. As a full-time employee who is currently working part-time, you may be eligible for partial benefit payments if:

- you are working all of the hours your employer offers to you; and,

- you earn less than your weekly benefit amount, plus any dependents’ allowance.

However, in this circumstance (full-time worker who is employed part-time), you must be able, available, and actively seeking full-time work to be eligible for UI benefits.

If you earn more than your weekly benefit amount, you will not be eligible for UI benefits.

5. Am I still eligible to receive UI benefits if I start working full-time?

If you start working full-time, whether the job is temporary or permanent, you are not entitled to unemployment benefits.

NOTE: If you are working what is considered full-time in your occupation, but earning wages that are less than your weekly benefit amount, you are considered to be “not unemployed.” Therefore, you are not entitled to total or partial unemployment benefits.

6. If I am an unemployed part-time worker and only looking for part-time work, am I eligible for UI benefits?

A part-time worker who has become unemployed and is only looking for part-time work may be eligible for UI benefits if the worker meets the definition and requirements included below:

A part-time worker is defined as an individual whose availability for work is restricted to part-time work, and who worked at least 20 hours per week in part-time work for the majority of weeks (at least 6 months) in the base period (i.e., the time period used to determine monetary eligibility for benefits). For more about the base period, see the Claims Filing - Initial Claims section of this webpage.

If you are a part-time worker, you are required to seek a job that offers the same number of work hours as your previous position. However, if you worked less than 20 hours per week at your last job, you are required to seek positions that offer at least 20 hours per week of work. The work must be in a labor market in which a reasonable demand for part-time work exists.

NOTE: If the part-time worker is working all of the hours available (i.e., 20 or more hours per week), regardless of whether the gross weekly wages are under the weekly benefit amount, the part-time worker would be considered “not unemployed” and would not be eligible for weekly UI payments.

7. Am I eligible for UI benefits if I am on a leave of absence from work?

For UI purposes, a leave of absence occurs when an employee is not able to perform the employee’s typical services for an employer, the employer agrees to allow the employee to temporarily stop working (while remaining connected to the employer), and the employee may return to perform their typical work when able to do so. Both the claimant and employer must agree to the conditions/dates for a leave of absence to exist.

If you are on a leave of absence, you may not be considered unemployed for UI purposes, as you are still connected to your employer. The Division may contact you to provide additional information about the circumstances surrounding your leave of absence.

Please note that each claimant’s circumstances are different, and your eligibility for UI benefits can not be determined until you file an initial claim. After you file an initial claim, the Division will determine whether you are eligible for benefits. For questions, contact a claims agent at 667-207-6520 (for agent hours, see the Claimant Contact Information webpage).

Information for Federal Employees

Reapplying for Unemployment Insurance (UI) Benefits in BEACON

1. Why do I need to reapply for unemployment insurance (UI) benefits?

Claimants need to reapply to re-establish their eligibility for UI benefits only under certain circumstances. These circumstances include, but are not limited to:

- The claimant’s monetary eligibility needs to be redetermined.

Note: A claimant is monetarily ineligible for benefits if the claimant does not have sufficient earnings from a covered employer in the base period. For example, a claimant’s monetary eligibility may change when the calendar quarter changes. To learn more about the base period, see the Claims Filing - Initial Claims section of this webpage. - The benefit year has expired.

Note: The benefit year is the 52-week period starting on the effective date, which is the Sunday of the week in which a new claim is filed.

If you need to reapply for benefits, you will see an Apply for Benefits tab on the left menu in your BEACON portal.

2. How do I determine if my benefit year has expired?

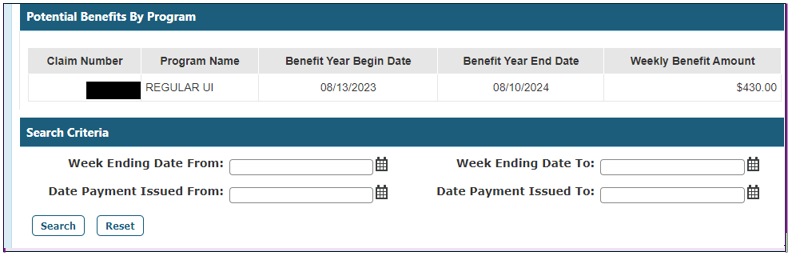

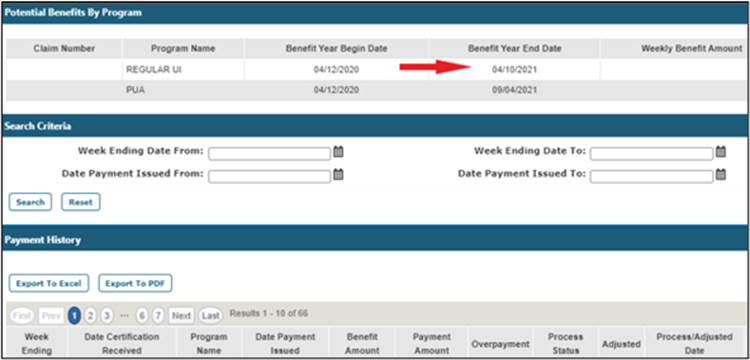

To determine if your benefit year has expired, select “Benefit Payment” from the left menu in your BEACON portal. Select “Payment History” and navigate to the Potential Benefits by Program section, as shown in the images below. Your benefit year expiration date is the date listed for your Regular UI claim in the Benefit Year End Date column.

3. How do I reapply?

If you wish to reapply for benefits, log in to your online BEACON portal, select the Apply for Benefits tab on the left menu and follow the prompts.

Note: You cannot complete this process from the MD Unemployment for Claimants mobile app.

4. If I have the Apply for Benefits tab in my portal, when should I reapply for benefits?

You should reapply as soon as possible. The sooner you reapply (by selecting “Apply for Benefits” in your BEACON portal and following the steps), the sooner you will be able to file your weekly claim certification and receive benefit payments, if eligible.

5. I applied for a new benefit year and now my account balance is $0. What happened to my previous balance?

When you apply for a new benefit year, any remaining benefits from the previous benefit year are not carried over to the new benefit year. If you are a Regular UI claimant who applied for a new benefit year and were determined to be monetarily ineligible for UI benefits, you will have a $0 account balance. A claimant is monetarily ineligible for benefits if the claimant does not have sufficient earnings from a covered employer in the qualifying base period.

6. How will I know if I am eligible for benefits after reapplying?

After the Maryland Division of Unemployment Insurance (the Division) determines whether you are eligible for UI benefits, the Division will send you a Statement of Wages and Monetary Eligibility determination (via your preferred communication method and available in your BEACON portal).

To access the determination in BEACON, select the Correspondence tab from your portal’s left menu and then select the search tab to view your correspondence.

7. What happens if I reapply and additional wages are detected?

If additional wages are detected and verified, you may be monetarily eligible for UI benefits. The wages you earned impact your monetary eligibility for benefits and the weekly benefit amount that you receive. However, you must still meet all other eligibility requirements to receive benefit payments. (see the Eligibility Requirements section of this webpage to learn more).

Repayment of UI Benefits for Furloughed Federal Employees

Trade Adjustment Assistance

TrueID Identity Verification Process

- What is TrueID?

TrueID is a tool the Maryland Division of Unemployment Insurance (the Division) uses to verify claimants’ identities. This tool was implemented to bolster the Division’s fraud prevention efforts and helps maintain the integrity of the unemployment insurance program. TrueID will replace the need to upload identity documents or to participate in identity verification video calls.

- Does TrueID include artificial intelligence (“AI”) or facial recognition software?

No, Maryland’s TrueID tool does not use AI or facial recognition to verify an individual’s identity; it validates photographs of identity documents uploaded via TrueID in order to verify identity.

- When do I start the TrueID process?

You may be prompted to complete the TrueID verification process when you apply for unemployment insurance benefits (also called filing an initial claim) in Maryland or when you update your information in the BEACON unemployment insurance system.

When you are prompted to complete TrueID, you will see a screen with the following options:

- I will complete the TrueID process;

-

After making this selection, you will receive an Action Item in your BEACON portal (when you log in to BEACON, you are automatically taken to your individual portal). To access your Action Items, select the Action Items link under the Alerts & Messages section of your portal. Select the Action Item to begin TrueID.

-

If you do not complete the Action Item within seven days of receiving it, you will receive a determination (sent through your preferred communication method; email, text message, or mail) stating that the Division is unable to verify your identity. Your claim for benefits will not be processed until the Division can verify your identity. You have the right to appeal the determination.

-

- I do not have a smartphone or tablet, or I do not wish to complete the TrueID process online; or,

-

If you select this option, you can complete the TrueID process in-person (see Question 6 for details).

-

If you do not verify your identity in-person within seven days of making this selection, you will receive a determination (sent through your preferred communication method; email, text message, or mail). Your claim for benefits will not be processed until the Division can verify your identity. You have the right to appeal this determination.

-

- I want to speak to a live agent.

-

A claims agent can answer your questions about TrueID, but cannot complete the process for you.

-

NOTE: If you are prompted to begin the TrueID process and you do not make a selection, you will receive a determination (you have the right to appeal this determination). The determination will be sent through your preferred communication method (email, text message, or mail). Your claim for benefits will not be processed until the Division can verify your identity.

- I will complete the TrueID process;

- What do I need to complete TrueID?

You need a valid (not expired):

-

driver’s license or state-issued ID card, (from any U.S. state) or

passport book or passport card (from any country);

You will also need a

-

smartphone or tablet that can take quality pictures; and,

-

phone number or email address associated with the smartphone or tablet that you are using to take the picture.

-

- If I do not have a driver’s license, state ID card, or passport/passport card, What can I use to verify my identity?

Please call a claims agent at 667-207-6520 during business hours for information about alternative identity verification documentation.

- How do I complete the TrueID process?

If you selected “complete TrueID” when you were prompted to begin the process, you will receive a TrueID Action Item in your BEACON portal. Please select the appropriate Action Item to begin (to access your Action Items, select the Action Items link under the Alerts & Messages section of your portal). To complete the TrueID process, you must:

take a picture of your valid photo ID (driver’s license, state ID card, passport, or passport card);

-

After you select “I will complete the TrueID process,” you will be asked to enter an email address or phone number associated with a smartphone or tablet. When you select the Action Item to begin TrueID, you will choose to receive the TrueID link either by email or text and you will be asked again to provide an email address/phone number which can receive messages.

-

Depending on your choice, a link will be sent to your smartphone/tablet by email or text message. Select the link and follow the prompts to take a picture of your ID.

-

You must take a picture of the front and back of your ID during the TrueID process. A picture you took previously, or a scanned copy of your ID, will not be accepted.

- The picture must be legible and in focus. Most smartphones allow you to tap your screen to help assist the camera’s focus.

NOTE: For information about how to take an acceptable picture, see the Image Hints and Tips - Driver’s License and the Image Hints and Tips - Passport documents.

-

When you take a picture of your ID, make sure that any barcodes and all four corners of the ID are visible.

-

If you passed TrueID, you will receive an eight-digit confirmation number.

This code is valid for 48 hours. After you receive the confirmation code, please log in to your BEACON portal within 48 hours. When prompted, enter the confirmation code to complete the TrueID process.

If you do not pass TrueID, you will receive a notice on the smartphone or tablet you used during the TrueID process. See Question 12 for more details.

-

If you do not receive a confirmation number or you see a notice stating you did not pass TrueID, you can repeat TrueID by selecting the previous TrueID action item.

- Are there any alternatives to completing TrueID online?

You must successfully complete the TrueID process before your initial claim for UI benefits will be processed.

If you are unable to complete the TrueID process online, you can bring your ID to one of the Maryland American Job Center (AJC) locations listed on the TrueID Assistance at American Job Centers webpage. At the AJC, a staff member will help you complete the TrueID process.

AJC staff will let you know whether you passed the TrueID process and next steps.

- What happens if I do not complete the TrueID process?

If the Division cannot verify your identity, you will receive a determination (sent through your preferred communication method; email, text message, or mail) stating that the Division is unable to verify your identity. Your claim for benefits will not be processed until the Division can verify your identity. You have the right to appeal the determination. If you do not have documentation that can be used to complete TrueID, please call a claims agent at 667-207-6520.

- Does the type of cell phone or tablet matter?

Yes, it must be a smartphone or tablet (capable of connecting to the internet) with a camera.

- If you have an Android device, you must use your front camera.

- You must take the picture during the TrueID process.

- You must take the picture with the same device that you are using to complete the TrueID process. For example, you cannot begin the TrueID process on your smartphone, and take a picture of your ID using a friend’s device.

- Is my photo ID stored?

An encrypted image of your photo ID will be kept on file for a limited time to help secure your account and prevent fraud.

- What should I do if I don’t have a smartphone/tablet?

If you do not own a smartphone/tablet but you have access to one (such as one that belongs to a family member), you may use the smartphone to complete the TrueID process. The phone number/email address does not have to be associated with you to complete TrueID.

If you are unable to borrow a device, you can complete the TrueID process in-person by visiting one of several Maryland American Job Center (AJC) locations listed in the TrueID Assistance at American Job Centers webpage (see Question 7). AJC staff will have access to a smartphone or tablet to assist you.

AJC staff will let you know whether you passed the TrueID process and next steps. See Question 7 for more details.

- How do I know if I passed TrueID?

If you passed, you will receive an eight-digit confirmation code on the smartphone or tablet you used during the TrueID process. After you receive the confirmation code, you must log in to your BEACON portal within 48 hours. When prompted, enter the confirmation code to complete the TrueID process. NOTE: Claimants who choose to verify their identity in-person will receive a notice informing them if they passed at the American Job Center location. The notice will include the confirmation code.

- What happens if I do not pass TrueID?

If you do not pass TrueID, you will receive a notice on the smartphone or tablet you used during the TrueID process.

A Maryland Division of Unemployment Insurance staff member will then review your ID and any other identity verification documentation you provided. You may also call a claims agent at 667-207-6520 during business hours for more information.

-

You may upload any additional identity verification documentation in your BEACON portal. AJC staff can help you with this process.

-

Please provide any additional identity verification documentation within seven days of completing the TrueID process.

If, after review, a staff member determines that the ID you provided is not acceptable, the Division will send you a determination. Your claim for benefits will not be processed until the Division can verify your identity.

The determination will be sent via your preferred method of communication (email, text message, or mail) . If you disagree with this determination, you have the right to file an appeal.

NOTE: Claimants who choose to verify their identity in-person will receive a notice informing them if they passed at the American Job Center location.

-

- I believe my information was used to fraudulently file a claim for unemployment benefits. What should I do?

You should complete a Request for Investigation of Unemployment Insurance Fraud form. Send the completed form by e-mail to ui.fraud@maryland.gov, or by mail to Maryland Department of Labor, ATTN: Benefit Payment Control, 100 South Charles Street, Tower 1, Baltimore, MD 21201.

1. What is the active search for work requirement?

You must satisfy certain requirements to be eligible for unemployment insurance benefits, including a requirement to actively search for work each week.

To meet Maryland's work search requirements, you must:

- register in the Maryland Workforce Exchange (MWE) system;

- upload or create a résumé in MWE, make the résumé viewable to employers, and maintain an up-to-date résumé while collecting UI benefits;

- After you complete your MWE registration, check your MWE inbox frequently for information about weekly tasks or actions that you are required to complete.

- complete at least three valid reemployment activities each week, which must include at least one job contact; and,

-

keep a detailed weekly record of all completed job contacts and valid reemployment activities. You are strongly urged to use the MWE Job Contact and Reemployment Activity Log (see the video tutorial), to keep this record.

- ○ Before you can record these activities in the log, you must register in MWE.

Failure to satisfy these requirements may result in a delay or denial of your benefits. If you received benefits during a week(s) in which you did not meet the work search requirement, the Division may determine you were overpaid benefits. (see the Audits, Overpayments, and Fraud FAQs for details).

2. How do I register with the Maryland Workforce Exchange? (MWE)

You are required to register in MWE online or in person at your local American Job Center. MWE registration is a one-time requirement.

NOTE: Registering with MWE does not replace the requirement to file your weekly claim certification. (for more, see the How to File a Weekly Claim Certification webpage).

To register:

- On the MWE website, select "Sign In/Register."

- Select “Individual Registration,” and follow the prompts. Once you have created an account, answer all mandatory questions (indicated with a red asterisk *).

- Note: If a partial user account was already created for you in MWE based on your application for UI benefits, you will see the following message: “We have identified an existing account in the system that matches your Social Security number. If you believe you made a data entry error please re-enter your correct Social Security number. Otherwise, please click here to retrieve your existing credentials and sign-in.” You should select the link to retrieve your existing credentials (user name, password, or both) and complete your registration.

- After you answer all required questions, upload your résumé. If you do not have a résumé, please create one in MWE. To upload/create your résumé, go to your dashboard, scroll down to Job Seeker Services and select “Résumé Builder.” From Résumé Builder, you may either upload or create your résumé in MWE. To get started, select “Create New Résumé.” You must maintain an up-to-date résumé in MWE while you are collecting unemployment insurance benefits.

- You must make your résumé viewable to employers in MWE. After choosing the “Create New Résumé” option, navigate to the Availability section and select “Allow employers to view my résumé online.”

- After registering, check your MWE inbox frequently for information about required weekly tasks. Failure to complete these tasks may result in a delay or denial of your benefits.

- Visit the MWE website to learn more. If you need further assistance with your MWE registration, contact dldwdwehelp-labor@maryland.gov.

3. What is a reemployment activity? What is a job contact?

Reemployment activities are activities that may reasonably lead to the claimant becoming reemployed, including those that help remove barriers to reemployment (see the valid reemployment activities page for a complete list). Several activities can be completed in MWE.

The following are examples of valid reemployment activities:

- Skills self-assessment;

- Virtual recruiter (to receive alerts about job postings);

- Work search completed through the Maryland Workforce Exchange (MWE);

- Outside web-linked job referral (CareerBuilder, Indeed, LinkedIn);

- Attended a job-related workshop posted in MWE;

- Completing a reemployment workshop, including: Reemployment Services and Eligibility Assessment (RESEA) workshop; or

- Initial development of an Individual Reemployment Plan (IRP).

A job contact refers to an action a claimant takes to contact an employer in an attempt to secure employment.

Job contacts may include, but are not limited to:

- submitting a job application to an employer (in person, email, online, fax);

- making an in-person contact with a potential employer;

- attending a job interview;

- contacting an employer through another method appropriate for the occupation; or,

- making contact through a method specified by the employer.

4. How do I document my valid reemployment activities and job contact(s)?

Job Contact and Reemployment Activity Log

The MWE Job Contact and Reemployment Activity log will prompt you to provide relevant contact information, the date of the activity, type of activity, and supporting documentation, among other information. If you complete any valid reemployment activities or make any job contacts in MWE, those activities will be automatically recorded for you in the log. Acceptable completed activities will display a green check mark (✔) in the same row.

If you completed any valid reemployment activities or made any job contacts outside of MWE, you will need to enter them manually. To do so:

- Log in to MWE. After you log in, you will be in your dashboard. To access the log, scroll down to the Unemployment Services section and select “Job Contact and Reemployment Activity Log.”

- After selecting the link, you have the option to: Enter or Review Your Job Contacts; or Enter or Review Your Reemployment Activities.

- To add a job contact, select “Enter or Review Your Job Contacts.”

- On the next screen, select “Enter a Job Contact.”

- Fill in all of the required fields (indicated with a red asterisk (*) and select “Save.”

- To add more job contacts, select “Enter a Job Contact” and repeat the process.

- To enter your reemployment activities, select the “Reemployment Activities” tab in the log.

- Select “Enter a Reemployment Activity.”

- Choose an activity from the Activity Type dropdown menu. You may need to upload documentation to substantiate the activity. Enter all of the information required, select “Choose File” to upload any supporting documentation that proves that you completed the activity, and then select “Save.”

- To enter another reemployment activity, select “Enter a Reemployment Activity” and repeat the process.

Certification and Self-Attestation: